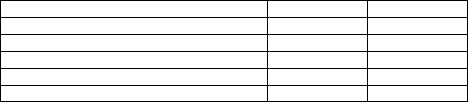

Art Parrish, the sole employee of Parrish Sales, has gross salary for March of $4,000. The entire amount is under the OASDI limit of $106,800, and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. Art has a deduction of $320 for health insurance and $80 for United Way. Please provide the second entry in the payroll cycle to record the disbursement of his net pay.

Definitions:

CTRL+SHIFT+LEFT ARROW

A keyboard shortcut commonly used in text editing to select text to the left of the cursor while holding down the CTRL and SHIFT keys.

SHIFT+RIGHT ARROW

A keyboard shortcut commonly used to select text or objects by extending the selection to the right.

Picture Tools Format

A feature or suite of tools in various software applications designed for editing and formatting images.

Currently Selected

The active selection or focus within a software environment, indicating that actions will apply to that item or area.

Q8: The following table shows analyst sentiment ratings

Q29: In a previous month, the business purchased

Q33: After extensive research, an analyst asserts that

Q36: For liabilities and revenues, a debit increases

Q36: Tim contributes capital into his business. The

Q48: Tractor World offers warranties on all their

Q80: Chebyshev's theorem is only applicable for sample

Q95: Tom's gross pay for the week is

Q114: The statistics professor has kept attendance records

Q134: The accountant for Hobson Electrical Repair Company