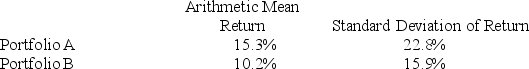

The table below gives statistics relating to a hypothetical 10-year record of two portfolios. Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.  Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Definitions:

No Demand

A market situation where there is no consumer desire or interest in purchasing a specific product or service.

Inconsistency

The state of being inconsistent; lack of uniformity or steadiness in actions, values, or outcomes.

Training

The process of teaching or developing in oneself or others, any skills and knowledge that relate to specific useful competencies.

Wedding Preparation Service

A business that offers planning and coordinating services for weddings, including venue selection, catering, and decorations.

Q1: The accompanying relative frequency distribution represents the

Q31: John lives in Los Angeles and hates

Q37: In the accompanying stem-and-leaf diagram, the values

Q44: As of September 30, the earnings per

Q64: A frequency distribution for qualitative data groups

Q81: The sample data below shows the number

Q90: For quantitative data, a cumulative relative frequency

Q125: Let P(A) = 0.4, P(B|A) = 0.5,

Q131: Testing whether the computer is infected or

Q135: The standard deviation is the positive square