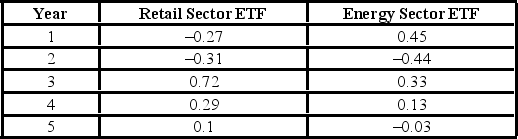

The following is return data for a retail sector ETF and energy sector ETF for the years, Year 1 to Year 5.  (See the Excel Data File.)

(See the Excel Data File.)

A) What is the arithmetic mean return for each ETF?

B) What is the geometric mean return for each ETF?

C) What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D) Given a risk free rate of 5%, what is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Definitions:

Cognitive Structures

Mental frameworks or patterns that help individuals organize and interpret information.

Perceptual Abilities

The capacity to interpret, analyze, and give meaning to sensory information.

Concrete Operational

A stage in Piaget's theory of cognitive development where children gain the ability to think logically about concrete events and understand the concept of conservation.

Piagetian Theory

Piagetian Theory refers to the cognitive development theory proposed by Jean Piaget, which suggests that children move through four stages of mental development.

Q3: A sample statistic is an estimate of<br>A)

Q4: Two events can be both mutually exclusive

Q36: The following are daily returns for the

Q48: Tractor World offers warranties on all their

Q50: On March 1, 2012, Archer Sales purchases

Q79: In which of the following periods should

Q102: Consider the following probability distribution. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg"

Q107: On October 1, 2012, Archer Sales borrows

Q121: Tractor World offers warranties on all their

Q139: The contingency table below provides frequencies for