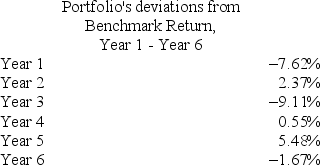

The table below gives the deviations of a portfolio's annual total returns from its benchmark's annual returns, for a six-year period ending in Year 6.  (See the Excel Data File.) The arithmetic mean return and median return are the closest to ________.

(See the Excel Data File.) The arithmetic mean return and median return are the closest to ________.

Definitions:

Diseconomies of Scale

The phenomenon where a company's production costs increase as it produces more, resulting in a decrease in efficiency.

Output Units

Quantitative measures of production, representing the number of units of goods or services produced.

Economies of Scale

Cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output decreasing with increasing scale.

Long-run Average Total Cost

The average cost per unit of output in the long run, where all inputs are considered variable and firms can adjust all factors of production.

Q14: The union of two events A and

Q37: Martin Supply Service received $1,000 cash from

Q42: Define the measurement scale of a car's

Q47: Estimated warranty payable would be included in

Q53: The following table displays the top 40

Q67: The following is data a veterinarian collected

Q82: A certain contingent liability was evaluated at

Q92: The annual returns (in percent) for a

Q96: If A and B are _ _

Q109: An analyst expects that 10% of all