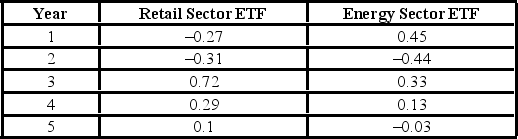

The following is return data for a retail sector ETF and energy sector ETF for the years, Year 1 to Year 5.  (See the Excel Data File.)

(See the Excel Data File.)

A) What is the arithmetic mean return for each ETF?

B) What is the geometric mean return for each ETF?

C) What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D) Given a risk free rate of 5%, what is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Definitions:

Structure

The arrangement or organization of components into a coherent, systematic, or orderly whole.

Increased

The state of having become larger or greater in size, amount, number, or degree.

Classical Organizational Theorists

Refer to scholars and thinkers who developed the initial frameworks and theories on how organizations are structurally and functionally designed for efficiency and productivity, including Max Weber and Frederick Taylor.

Modular Organization

A network organization that performs a few core functions and outsources other activities to specialists and suppliers.

Q1: Which of the following meets the requirements

Q5: When reading published statistics (numerical facts), you

Q48: Every 10 years, a census is taken

Q51: Arc Digital starts the year with balances

Q69: The owner of a company has recently

Q72: The following contingency table provides frequencies for

Q93: A _ represents all possible subjects of

Q94: Gold miners in Alaska have found, on

Q102: Exams are approaching and Helen is allocating

Q111: Each month the Bureau of Labor Statistics