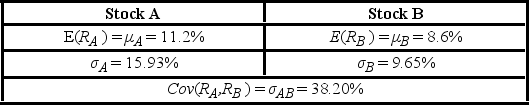

An investor has a $120,000 portfolio of which $50,000 has been invested in Stock A and the remainder in Stock B. Other characteristics of the portfolio are as follows:  a. Calculate the correlation coefficient.

a. Calculate the correlation coefficient.

B) Calculate the expected return of the portfolio.

C) Calculate the standard deviation of the portfolio.

Definitions:

Other Comprehensive Income Items

Components of comprehensive income that are not part of net income, including items such as unrealized gains and losses on available-for-sale securities.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating the profitability of a company's core activities.

Operating Expenses

Costs incurred during the normal course of business operations, excluding the cost of goods sold.

Income from Operations

Earnings generated from a company's regular, core business activities before interest and taxes.

Q3: The 150 residents of the town of

Q7: The mean of a continuous uniform distribution

Q22: A _ _ is a table that

Q43: A stem-and-leaf diagram is constructed by separating

Q46: The following frequency distribution represents the number

Q53: Find the following probabilities for a standard

Q54: Amounts spent by a sample of 50

Q89: Use the following data to construct a

Q102: What type of relationship is indicated in

Q120: According to a study by the Centers