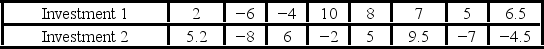

Consider the expected returns (in percent) from the two investment options. Beth claims that the variances of the returns for the two investments differ. Use the following data to arrive at the results.  Which of the following is the correct p-value?

Which of the following is the correct p-value?

Definitions:

Effectiveness Rates

The proportion or percentage in which a particular treatment, procedure, or strategy achieves its intended purpose.

African American

An ethnic group in the United States with total or partial ancestry from any of the black racial groups of Africa.

College Students

Individuals enrolled in an institution of higher education, typically pursuing undergraduate or graduate degrees.

Literacy Environment

the surrounding conditions that provide opportunities for reading and writing and influence the development of literacy skills.

Q3: Two or more random samples are considered

Q14: The F test can be applied for

Q43: The ages of MBA students at a

Q57: Which of the following is the value

Q61: For a one-way ANOVA, which of the

Q63: If a small segment of the population

Q64: The heights (in cm) for a random

Q84: The following ANOVA table was obtained when

Q88: A key metric in the cell phone

Q125: A computer manufacturer believes that the proportion