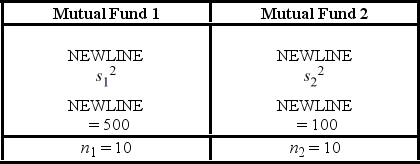

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ. To support his claim, he collects data on the annual returns (in percent) for the years 2001 through 2010. The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed. Use the following summary statistics.  The competing hypotheses are Η0:

The competing hypotheses are Η0:  /

/  = 1, ΗA:

= 1, ΗA:  /

/  ≠ 1, At α = 0.10, is the analyst's claim supported by the data?

≠ 1, At α = 0.10, is the analyst's claim supported by the data?

Definitions:

Genetic Testing

The analysis of DNA, RNA, chromosomes, proteins, or certain metabolites in order to detect alterations related to a heritable condition or disease.

Ovarian Cancer

A type of cancer that originates in the ovaries, characterized by the uncontrolled growth of cells within the ovarian tissues.

Colonic Polyps

Noncancerous growths that can develop on the inner lining of the colon, with potential to become cancerous over time if not removed.

Personal History

A record of an individual's past experiences and events that may affect their health status.

Q4: In August 2010, Massachusetts enacted a 150-day

Q29: John is an undergraduate business major studying

Q36: The following frequency distribution shows the monthly

Q53: Paul owns a mobile wood-fired pizza oven

Q59: For a two-tailed test about two population

Q78: The Excel's function _ returns the p-value

Q90: When testing the difference between two population

Q104: Weather forecasters would like to report on

Q104: Billy wants to test whether the average

Q112: The ANOVA test performed for determined that