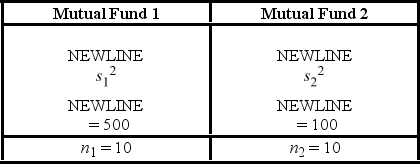

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ. To support his claim, he collects data on the annual returns (in percent) for the years 2001 through 2010. The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed. Use the following summary statistics.  For the competing hypotheses Η0:

For the competing hypotheses Η0:  /

/  = 1, ΗA:

= 1, ΗA:  /

/  ≠ 1, which of the following is the correct approximation of the p-value?

≠ 1, which of the following is the correct approximation of the p-value?

Definitions:

Renal Cortex

The outer portion of the kidney where initial filtration of blood takes place.

Urogenital Sinus

A part of the embryonic development stage which eventually forms parts of the urinary and genital tracts.

Uterine Horn

The pointed end of the uterus where it meets the fallopian tubes in many animals, playing a key role in the reproductive system.

Urinary Bladder

A muscular sac in the pelvic cavity that stores urine before it is excreted from the body.

Q1: If s<sup>2</sup> is computed from a random

Q9: In a simple linear regression model, if

Q10: You would like to determine if there

Q29: A farmer plants tomato seeds into four

Q42: A correlation coefficient r = −0.85 could

Q66: Which of the following are one-tailed tests?<br>A)

Q79: Assume the competing hypotheses take the following

Q100: A hypothesis test regarding the population mean

Q104: Weather forecasters would like to report on

Q120: A large city installed LED streetlights, in