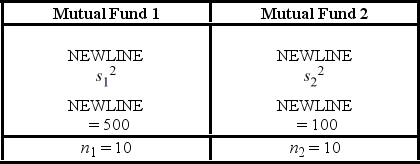

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ. To support his claim, he collects data on the annual returns (in percent) for the years 2001 through 2010. The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed. Use the following summary statistics.  The competing hypotheses are Η0:

The competing hypotheses are Η0:  /

/  = 1, ΗA:

= 1, ΗA:  /

/  ≠ 1, At α = 0.10, is the analyst's claim supported by the data?

≠ 1, At α = 0.10, is the analyst's claim supported by the data?

Definitions:

Income Distribution

How total earnings are distributed across individuals or households within an economy.

Equal Slices

A method of dividing or allocating resources, goods, or profits evenly among all parties or members.

Corporate Stock Holdings

The shares of a corporation held by an individual, group, or another corporation, representing ownership interests.

Q5: A farmer is concerned that a change

Q9: In a simple linear regression model, if

Q21: Suppose Apple would like to test the

Q35: A sports analyst wants to exam the

Q46: We draw a random sample of size

Q48: A travel agent wants to determine if

Q49: A researcher analyzes the relationship between amusement

Q68: Amie Jackson, a manager at Sigma travel

Q103: The between-treatments variance is the estimate of

Q116: A sports analyst wants to exam the