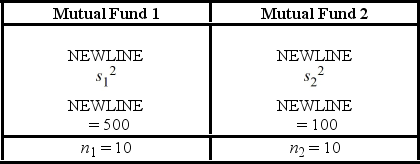

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ. To support his claim, he collects data on the annual returns (in percent) for the years 2001 through 2010. The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed. Use the following summary statistics.  The competing hypotheses are Η0:

The competing hypotheses are Η0:  /

/  = 1, ΗA:

= 1, ΗA:  /

/  ≠ 1. At α = 0.10, is the analyst's claim supported by the data using the critical value approach?

≠ 1. At α = 0.10, is the analyst's claim supported by the data using the critical value approach?

Definitions:

Q2: A scatterplot graphically shows the relationship between

Q19: According to the recent report, scientists in

Q29: In a recent investigation, the National Highway

Q30: Given the _ of the z distribution,

Q37: Suppose residents in a well-to-do neighborhood pay

Q59: For a two-tailed test about two population

Q60: A school is required by the government

Q74: A researcher with the Ministry of Transportation

Q86: For a given confidence level 100(1 -

Q87: An analyst takes a random sample of