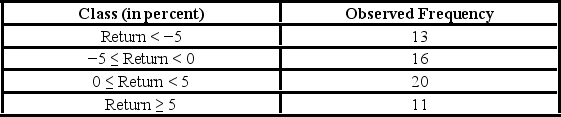

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. At the 5% confidence level, which of the following is the correct conclusion for the Jarque-Bera test for normality?

Over time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. At the 5% confidence level, which of the following is the correct conclusion for the Jarque-Bera test for normality?

Definitions:

Convertible Bond

A type of bond that can be converted into a predetermined number of shares of the issuing company's equity at certain times during its life, usually at the discretion of the bondholder.

New Shares

New shares refer to additional stock issued by a company, either through public offerings or other means, to raise capital.

Put Option

A financial contract that gives the owner the right, but not the obligation, to sell a specified amount of an underlying security at a predetermined price within a specified time frame.

Option Price

The price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Q6: The Institute of Education Sciences measures the

Q17: In the following table, individuals are cross-classified

Q23: In August 2010, Massachusetts enacted a 150-day

Q25: A marketing analyst wants to examine the

Q25: In general, a blocking variable is used

Q33: You want to test whether the population

Q90: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="When estimating

Q95: A researcher analyzes the factors that may

Q105: A car dealer who sells only late-model

Q109: Over the past 30 years, the sample