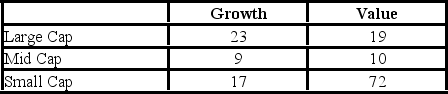

The following table shows the cross-classification of hedge funds by market capitalization (either small, mid, or large cap) and objective (either growth or value).  a. Set up the competing hypotheses to determine if market capitalization and objective are dependent.

a. Set up the competing hypotheses to determine if market capitalization and objective are dependent.

B) Calculate the value of the test statistic and determine the degrees of freedom.

C) Compute the p-value. Does the evidence suggest market capitalization and objective are dependent at the 5% significance level?

Definitions:

Economic Factors

Elements that influence the behavior of an economy, including inflation, employment rates, and growth rate.

Life Expectancy

The average period that an individual is expected to live based on demographic factors.

Health Expectancy

An estimate of how many years an individual can expect to live in a state of good health, taking into account current rates of morbidity and mortality.

African Americans

An ethnic or racial group in the U.S. that can trace its heritage to any of Africa's black racial groups.

Q9: The Boston public school district has had

Q10: An advertisement for a popular weight-loss clinic

Q18: The heights (in cm) for a random

Q42: A schoolteacher is worried that the concentration

Q68: Amie Jackson, a manager at Sigma travel

Q75: A farmer is concerned that a change

Q79: How does the width of the interval

Q84: A researcher with the Ministry of Transportation

Q87: Annual growth rates for individual firms in

Q97: The term BLUE stands for Best Linear