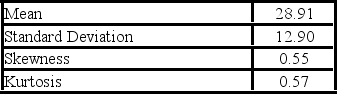

The following table shows numerical summaries of the best quarter returns (in percentages) for a sample of 121 hedge funds.  a. Set up the competing hypotheses for the Jarque-Bera test for normality for the best quarter returns.

a. Set up the competing hypotheses for the Jarque-Bera test for normality for the best quarter returns.

B) Calculate the value of the test statistic.

C) Specify the critical value at the 1% significance level.

D) Does the evidence suggest that the best quarter returns do not have a normal distribution?

Definitions:

Group Harmony

The degree to which members of a group or society are able to live together in a peaceful and cooperative manner.

Personality Traits

Enduring characteristics that describe an individual's behavior, such as extraversion or conscientiousness.

Occupational Terms

Specific terms and jargon used within particular professions or industries to describe roles, tasks, processes, and equipment.

Behavioral Genetic

A field of study that examines the role of genetic and environmental influences on behaviors.

Q12: Over the past 30 years, the sample

Q35: A schoolteacher is worried that the concentration

Q56: A manager at a local bank analyzed

Q73: A marketing analyst wants to examine the

Q78: An economist estimates the following model: y

Q84: The following ANOVA table was obtained when

Q91: A researcher wants to understand how an

Q105: A statistics professor at a large university

Q120: One of the assumptions of regression analysis

Q121: A particular bank has two loan modification