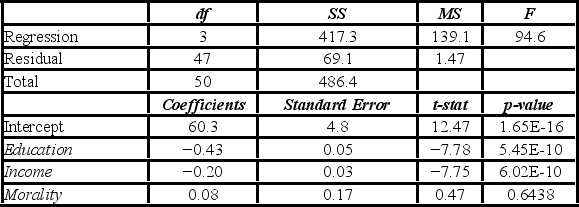

A sociologist examines the relationship between the poverty rate and several socioeconomic factors. For the 50 states and the District of Columbia (n = 51) , he collects data on the poverty rate (y, in %) , the percent of the population with at least a high school education (x1) , median income (x2, in $1000s) , and the mortality rate per 1,000 residents (x3) . He estimates the following model as y = β0 + β1Education + β2Income + β3Mortality + ε. The following ANOVA table shows a portion of the regression results.  The coefficient of determination indicates that ________.

The coefficient of determination indicates that ________.

Definitions:

Variable Costing

A financial recording method that counts only the variable expenses related to production (direct materials, direct labor, and variable manufacturing overhead) in the pricing of products.

Variable Costing

A financial recording approach that incorporates only variable manufacturing expenses, such as raw materials, direct workforce, and fluctuating production overheads, into the costs of goods produced.

Net Operating Income

A financial term representing the profit made from a company’s operations, after subtracting operating expenses from operating income.

Absorption Costing

The product cost determination method under this accounting strategy includes the expenses for direct materials, direct labor, and all manufacturing overhead, whether it is variable or fixed.

Q5: An investment analyst wants to examine the

Q10: The following table shows the annual revenues

Q31: Consider the following simple linear regression model:

Q38: A new study has found that, on

Q42: The following data show the cooling temperatures

Q68: Given the following portion of regression results,

Q81: The following data show the demand for

Q84: The restricted model is a reduced model

Q89: Use the F table to approximate these

Q129: An over-the-counter drug manufacturer wants to examine