An investment analyst wants to examine the relationship between a mutual fund's return, its turnover rate, and its expense ratio. She randomly selects 10 mutual funds and estimates:

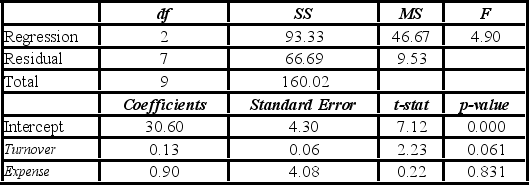

Return = β0 + β1Turnover + β2Expense + ε, where Return is the average five-year return  , Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.

, Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.  a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B) Interpret the slope coefficient for the variable Expense.

C) Calculate the standard error of the estimate.

D) Calculate and interpret the coefficient of determination.

Definitions:

World War I

A global conflict that took place primarily in Europe from 1914 to 1918, involving many of the world's great powers.

GDP

Gross Domestic Product is the term for the collective monetary or market value of every good and service completed within the limits of a country in a set timeframe.

Export-import Sector

The segment of an economy involved in the exchange of goods and services across international borders.

Quality Codes

Standards or systems used to categorize and ensure the level of quality or integrity of products, processes, or materials.

Q14: The R<sup>2</sup> of a multiple regression of

Q15: A real estate analyst believes that the

Q16: The model y = β<sub>0</sub> + β<sub>1</sub>x

Q65: A researcher wants to understand how an

Q79: Regression models that use a dummy variable

Q81: A real estate analyst believes that the

Q90: A medical researcher is interested in assessing

Q94: The following table shows the distribution of

Q112: An over-the-counter drug manufacturer wants to examine

Q118: A sociologist wishes to study the relationship