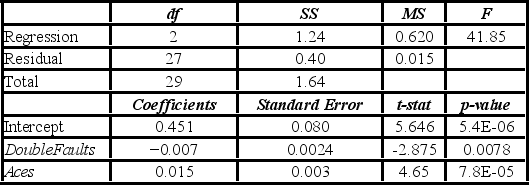

Data was collected for 30 professional tennis players regarding their performance in Grand Slams (the four major tennis tournaments in the world). The response variable Win, expressed as a proportion ranging from 0 to 1, is believed to depend on two explanatory variables: the percentage of the Double Faults and the number of Aces. The following model is estimated: Win = β0 + β1DoubleFaults + β2Aces + ε. A portion of the regression results is shown in the accompanying table.  a. Predict the winning percentage for a player who had 20 double faults and five aces.

a. Predict the winning percentage for a player who had 20 double faults and five aces.

B) Interpret the slope coefficient for the variable DoubleFaults.

C) Calculate the standard error of the estimate.

D) Calculate and interpret the coefficient of determination.

E) Calculate the adjusted R2.

Definitions:

Risk Premium

The extra return expected by investors for holding a riskier investment over a risk-free asset.

Diversifiable Risk

Is the type of investment risk that can be reduced through diversification of a portfolio, related to specific factors affecting individual companies or sectors.

Market Rewards

The returns or gains that investors expect to earn from their investments in the financial markets.

Non-diversifiable Risks

Risks that affect all investments across the market and cannot be mitigated through diversification.

Q8: In regression, the predicted values concerning y

Q10: The following is an incomplete ANOVA table.

Q22: A police chief wants to determine if

Q22: When the decomposition model, y<sub>t</sub> = T<sub>t</sub>

Q39: Students of two sections of a history

Q51: The following table shows the distribution of

Q62: A marketing analyst wants to examine the

Q66: A market researcher is studying the spending

Q91: The following are the measures based on

Q92: The <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="The distribution