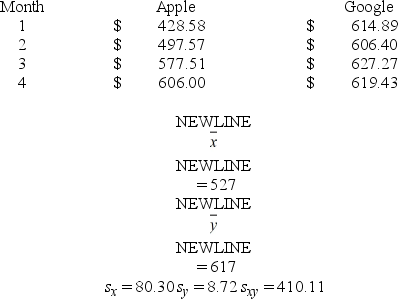

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little, if any, correlation. He wonders whether the stock prices for the firms Apple and Google are correlated. As a very preliminary step, he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a. Compute the sample correlation coefficient.

a. Compute the sample correlation coefficient.

B) Specify the competing hypotheses to determine whether the stock prices are correlated.

C) Calculate the value of the test statistic and approximate the corresponding p-value.

D) At the 5% significance level, what is the conclusion to the test? Explain.

Definitions:

Reward

Benefits, compensation, or recognition given to employees in exchange for their work, performance, or a specific achievement.

Behavior

The way an individual or group responds or behaves in reaction to stimuli coming from outside or within.

Primary Reinforcer

An innately satisfying stimulus, such as food or comfort, that fulfills a basic biological need and does not require learning to be effective.

Reward

Any form of compensation, recognition, or benefit used to reinforce positive behavior and outcomes within an organization.

Q7: A bank manager is interested in assigning

Q11: The linear trend model, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="The

Q26: A card-dealing machine deals spades (1), hearts

Q50: Which of the following is the Fisher's

Q68: Given the following portion of regression results,

Q69: For the model y = β<sub>0 </sub>+

Q72: For a one-way ANOVA, which of the

Q86: A realtor wants to predict and compare

Q91: It is common to refer to the

Q113: An over-the-counter drug manufacturer wants to examine