An investment analyst wants to examine the relationship between a mutual fund's return, its turnover rate, and its expense ratio. She randomly selects 10 mutual funds and estimates:

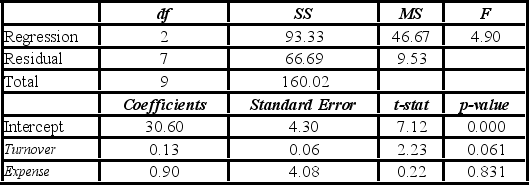

Return = β0 + β1Turnover + β2Expense + ε, where Return is the average five-year return  , Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.

, Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.  a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B) Interpret the slope coefficient for the variable Expense.

C) Calculate the standard error of the estimate.

D) Calculate and interpret the coefficient of determination.

Definitions:

Nonprogrammed

Decisions or actions that are made to address unique, non-recurring situations that require specific handling.

Programmed

Refers to actions, decisions, or operations that are established in advance through a set of rules or algorithms.

Nonprogrammed

relates to decision-making or solutions that are not based on established procedures or guidelines, often required in unique, unforeseen, or complex situations.

Complex Nature

The intricate and multifaceted characteristics of a system, problem, or entity that make it challenging to understand or manage.

Q22: A university has six colleges and takes

Q25: For the logit model, the predicted values

Q38: The one-way ANOVA null hypothesis is rejected

Q53: The exponential smoothing method weighs all available

Q60: A bank manager is interested in assigning

Q70: A logit model ensures that the predicted

Q71: An economist estimates the following model: y

Q79: The exponential trend model is attractive when

Q111: Variables employed in a regression model can

Q112: Amie Jackson, a manager at Sigma travel