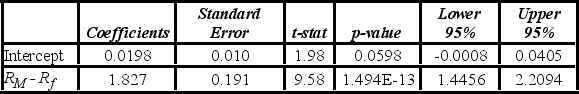

Tiffany & Co. has been the world's premier jeweler since 1837. The performance of Tiffany's stock is likely to be strongly influenced by the economy. Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) . The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Tiffany's return.  When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

Definitions:

Yield

The income return on an investment, such as the interest or dividends received, expressed as a percentage of the investment's cost or current market value.

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates, typically expressed in years.

Price Volatility

The rate at which the price of a security increases or decreases for a given set of returns, often measured by the standard deviation of historical daily price changes.

Q4: Psychology students want to determine if there

Q6: Multicollinearity is suspected when _.<br>A) there is

Q20: If the year 2000 is used as

Q37: A residual is the difference between the

Q48: A researcher wants to understand how an

Q88: The following table includes the information about

Q90: Quantitative forecasting procedures are based on the

Q97: In the following table, likely voters' preferences

Q108: A bank manager is interested in assigning

Q124: A multiple regression model with four explanatory