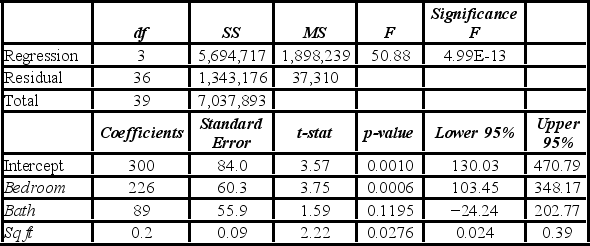

A real estate analyst believes that the three main factors that influence an apartment's rent in a college town are the number of bedrooms, the number of bathrooms, and the apartment's square footage. For 40 apartments, she collects data on the rent (y, in $) , the number of bedrooms (x1) , the number of bathrooms (x2) , and its square footage (x3) . She estimates the following model: Rent = β0 + β1Bedroom + β2Bath + β3Sqft + ε. The following table shows a portion of the regression results.  When testing whether the explanatory variables are jointly significant at the 5% level, she ________.

When testing whether the explanatory variables are jointly significant at the 5% level, she ________.

Definitions:

Like-kind Exchange

A tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset without generating a tax liability from the sale of the first asset.

Installment Method

A tax procedure that allows the taxpayer to spread the income and taxes owed on the sale of property over the period in which the payments are received.

Gross Profit Percentage

A financial ratio showing the proportion of money left over from revenues after accounting for the cost of goods sold.

Contract Price

The total amount agreed upon in a contract for the sale of goods, services, or property.

Q7: Typically, the sales volume declines with an

Q34: Given the following portion of regression results,

Q34: When using Excel for calculating moving averages,

Q53: The exponential smoothing method weighs all available

Q58: A researcher wants to examine how the

Q67: When a time series has both trend

Q67: The ANOVA test performed for determined that

Q70: One-way ANOVA is used to determine if

Q72: The following data show the cooling temperatures

Q111: Consider the partially completed two-way ANOVA (with