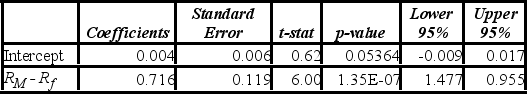

Pfizer Inc. is the world's largest research-based pharmaceutical company. Monthly data for Pfizer's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60). The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Pfizer's return.  a. At the 5% significance level, is the beta coefficient less than one? Show the relevant steps of the appropriate hypothesis test.

a. At the 5% significance level, is the beta coefficient less than one? Show the relevant steps of the appropriate hypothesis test.

B) At the 5% significance level, are there abnormal returns? Show the relevant steps of the appropriate hypothesis test.

Definitions:

In The Money

Describes an option whose exercise would produce a positive cash flow. Out of the money describes an option where exercise would result in a negative cash flow.

Intrinsic Value

The perceived or calculated true value of an asset, investment, or company, based on fundamentals, without regard to market value.

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a specified amount of an underlying asset at a predetermined price within a specified time frame.

At The Money

A situation in options trading where the strike price of an option is equal to the market price of the underlying asset.

Q12: Timothy Keating invested $120 in buying a

Q15: A real estate analyst believes that the

Q28: The chi-square test of a contingency table

Q34: Given the following portion of regression results,

Q49: A market researcher is studying the spending

Q51: In a simple linear regression model, if

Q66: An analyst examines the effect that various

Q91: A researcher wants to understand how an

Q95: The cubic regression model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="The

Q100: Based on quarterly data collected over the