A researcher wants to examine how the remaining balance on $100,000 loans taken 10 to 20 years ago depends on whether the loan was a prime or subprime loan. He collected a sample of 25 prime loans and 25 subprime loans and recorded the data in the following variables: Balance = the remaining amount of loan to be paid off (in $) ,

Time = the time elapsed from taking the loan,

Prime = a dummy variable assuming 1 for prime loans, and 0 for subprime loans.

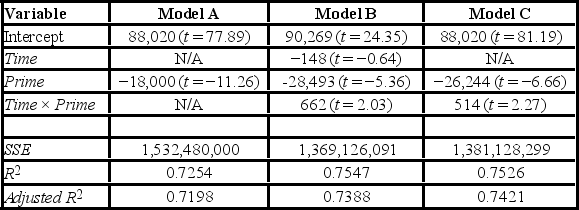

The regression results obtained for the models:

Model A: Balance = β0 + β1Prime + ε

Model B: Balance = β0 + β1Time + β2Prime + β3Time × Prime + ε

Model C: Balance = β0 + β1Prime + β2Time × Prime + ε,

Are summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Which of the following three models would you choose to make the predictions of the remaining loan balance?

Definitions:

Capital Structure

The mix of different forms of external financing used by a company, including debt, equity, and hybrid securities.

Tax Shield

The decrease in income tax liability achieved by subtracting permissible deductions like mortgage interest or depreciation from one's taxable income.

Capital Structure

The assortment of loans and equity a firm leverages to finance its daily workings and growth aspirations.

Legal Obligation

A duty enforced by law that requires an entity or individual to perform or refrain from certain actions.

Q2: Which of the following features of options

Q11: Consider the following simple linear regression model:

Q17: An exchange-traded option contract is:<br>A)a method by

Q21: The quadratic regression model allows for one

Q24: The income yield from a one-year infrastructure

Q28: A realtor wants to predict and compare

Q49: A researcher analyzes the relationship between amusement

Q56: For the Wald-Wolfowitz runs test with n<sub>1</sub>

Q85: The coefficient of determination R<sup>2</sup> cannot be

Q93: Option buyers:<br>A)are not required to make margin