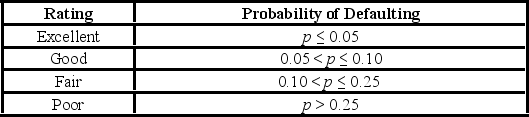

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank. The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability, she decided to use the logit model,

To estimate this probability, she decided to use the logit model,

P =  , where

, where

y = a binary response variable which is 1 if the credit card is in default and 0 otherwise

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

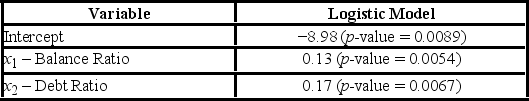

The following output is obtained.  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

If only applicants with excellent and good ratings are qualified for a loan, find a linear relation between their balance ratio and their debt ratio that must be satisfied to be qualified.

Definitions:

Breaking A Habit

The process of ending a repetitive behavior or pattern that is considered negative or harmful.

Self-exploration

The process of examining one's own thoughts, feelings, motivations, and behaviors to gain insight or self-awareness.

Job Satisfaction

The level of contentment employees feel about their work, which can affect their performance and well-being.

Right Livelihood

A concept in Buddhism referring to ethical and morally appropriate choices in one's career or means of earning.

Q15: When comparing polynomial trend models, we use

Q32: A call option can be used to

Q48: A sports analyst wants to exam the

Q55: It is believed that the sales volume

Q59: The following table provides the values of

Q66: A $12.00 call that cost 65 cents

Q79: A sports analyst wants to exam the

Q96: Consider the following simple linear regression model:

Q130: The option seller can be referred to

Q131: What is an option's 'implied volatility'?