A researcher wants to examine how the remaining balance on $100,000 loans taken 10 to 20 years ago depends on whether the loan was a prime or subprime loan. He collected a sample of 25 prime loans and 25 subprime loans and recorded the data in the following variables: Balance = the remaining amount of loan to be paid off (in $) ,

Time = the time elapsed from taking the loan,

Prime = a dummy variable assuming 1 for prime loans, and 0 for subprime loans.

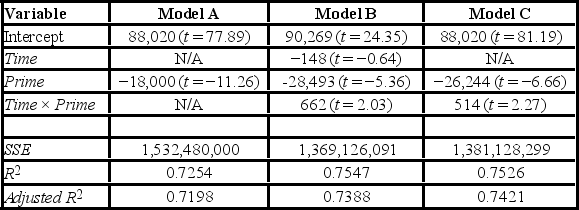

The regression results obtained for the models:

Model A: Balance = β0 + β1Prime + ε

Model B: Balance = β0 + β1Time + β2Prime + β3Time × Prime + ε

Model C: Balance = β0 + β1Prime + β2Time × Prime + ε,

Are summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Which of the following three models would you choose to make the predictions of the remaining loan balance?

Definitions:

Q4: Psychology students want to determine if there

Q14: Which of the following regression models is

Q17: An exchange-traded option contract is:<br>A)a method by

Q25: In a multiple regression based on 30

Q41: An over-the-counter drug manufacturer wants to examine

Q44: For the logarithmic model y = β<sub>0</sub>

Q46: Tukey's HSD 100(1 − α)% confidence interval

Q77: For the Wilcoxon rank-sum test when the

Q100: A real estate analyst believes that the

Q116: The correlation coefficient is unit-free.