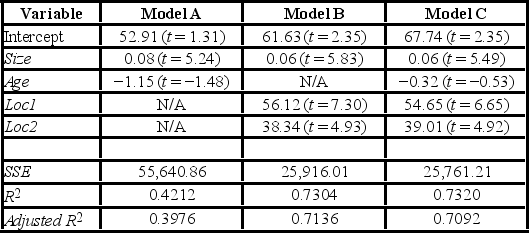

A realtor wants to predict and compare the prices of homes in three neighboring locations. She considers the following linear models:

Model A: Price = β0 + β1 Size + β2 Age + ε

Model B: Price = β0 + β1 Size + β3 Loc1 + β4 Loc2 + ε

Model C: Price = β0 + β1 Size + β2 Age + β3 Loc1 + β4 Loc2 + ε

where,

Price = the price of a home (in $1,000s)

Size = the square footage (in sq. feet)

Loc1 = a dummy variable taking on 1 for Location 1, and 0 otherwise

Loc2 = a dummy variable taking on 1 for Location 2, and 0 otherwise

After collecting data on 52 sales and applying regression, her findings were summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Using Model C, what is the conclusion for testing the joint significance of the two dummy variables at the 1% significance level?

Definitions:

Horizontal Axis

In graphing, the horizontal line along which the values of one variable are plotted, often representing the independent variable or time.

Multiply Controlled Behaviors

A term used to describe a behavior serving different purposes for a student (e.g., making animal noises to escape a boring task and to get attention from peers).

Transfer of Function

The process by which a response or behavior developed in one context becomes applicable or relevant in another context.

Experimental Control

The rigorous management of variables in an experiment to ensure that the results can be reliably attributed to the variable being tested, rather than to extraneous factors.

Q5: When the model y<sub>t</sub> = T<sub>t</sub> ×

Q28: If today were the expiry date, would

Q29: John is an undergraduate business major studying

Q31: The nonparametric test for a single population

Q57: Toyota Motor Corp., once considered a company

Q81: Given the augmented Phillips model: y =

Q88: A sports agent wants to understand the

Q92: A university advisor wants to determine if

Q102: The deterministic component of the simple linear

Q115: When testing whether the correlation coefficient differs