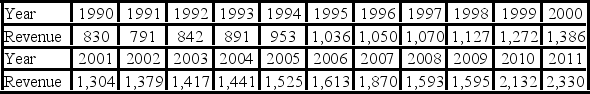

The following table shows the annual revenues (in millions of dollars) of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

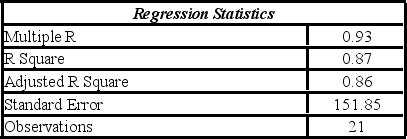

Model AR(1):

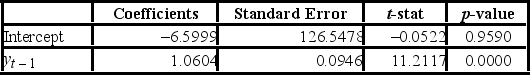

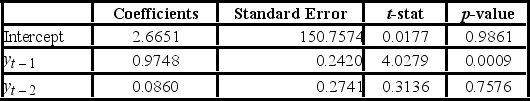

Model AR(2):

Model AR(2):

Compare Excel outputs for AR(1) and AR(2) and choose the forecasting model that seems to be better.

Compare Excel outputs for AR(1) and AR(2) and choose the forecasting model that seems to be better.

Definitions:

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects revenue from its credit customers, calculated by dividing net credit sales by the average accounts receivable.

Allowance Method

An accounting technique used to estimate and account for doubtful debts, providing a more accurate representation of financial health.

Bad Debts Expense

Bad debts expense represents the portion of receivables that a company estimates it will not be able to collect.

Allowance for Doubtful Accounts

An accounting provision made by companies to account for potential future bad debts, reflecting credit sales that might not be collected.

Q13: Consider the following information about the price

Q38: At expiry, a holder of a call

Q48: The timing of plain vanilla swap payments

Q63: A researcher analyzes the factors that may

Q65: If the BBSW is below the swap

Q78: For the Kruskal-Wallis test with n<sub>i</sub> ≥

Q80: A medical researcher is interested in assessing

Q85: Why can parties enter a plain vanilla

Q90: Quantitative forecasting procedures are based on the

Q119: In the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="In