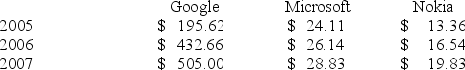

Lindsay Kelly bought 100 shares of Google, 300 shares of Microsoft, and 500 shares of Nokia in January 2005. The adjusted close prices of these stocks over the next three years are shown in the accompanying table.  Which of the following is the weighted aggregate price index for Lindsay's portfolio for 2007, using 2005 as the base year?

Which of the following is the weighted aggregate price index for Lindsay's portfolio for 2007, using 2005 as the base year?

Definitions:

Immigrants

Individuals who move to a country different from their country of origin for the purposes of settling, working, or studying.

Financial Payments

Transactions involving the transfer of money or other monetary instruments from one party to another as compensation or for acquiring goods or services.

Immigration Effects

The impact of immigration on the economy, labor markets, and demographics of a country.

Average Wage Rate

The mean hourly rate of pay for workers in a specific region or sector, calculated by dividing total wages by the number of workers.

Q18: Ideally, the chosen model is best in

Q19: The fixed-rate payer's position in a swap

Q29: An over-the-counter drug manufacturer wants to examine

Q35: To examine the differences between salaries of

Q38: The following data show the cooling temperatures

Q63: Three firms, X, Y, and Z, operate

Q76: The nonparametric test for ordinal data based

Q81: Explain why basis risk is likely to

Q100: Trading futures contracts does not usually involve

Q112: The moving average method is one of