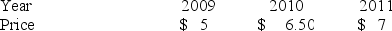

The following table provides the prices of a good over three consecutive years.  a. Compute the simple price index for 2010 using 2009 as the base year.

a. Compute the simple price index for 2010 using 2009 as the base year.

B) If the base year is changed to 2010, compute the simple price index for 2011.

Definitions:

Progressive Tax

Progressive tax is a taxation system where the tax rate increases as the taxable amount or income increases, placing a higher burden on those with higher incomes.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), essentially reflecting the percentage of income that is paid in taxes.

Marginal Tax Rate

The rate at which the next dollar of taxable income is taxed.

Taxable Income

The amount of an individual's or entity's income used as the basis for calculating how much tax they owe to the government, after deductions and exemptions.

Q5: The scatterplot shown below represents a typical

Q13: Consider the following information about the price

Q20: It is believed that the sales volume

Q21: Investment institutions usually have funds with different

Q36: Joanna Robertson bought a share of XYZ

Q63: Three firms, X, Y, and Z, operate

Q66: To examine the differences between salaries of

Q79: A trading magazine wants to determine the

Q80: For a floating rate borrower wishing to

Q125: If the model y<sub>t</sub> = T<sub>t</sub> ×