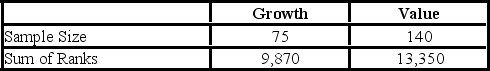

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) . The fund manager collects data on the returns of growth and value funds. Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

Definitions:

Fair Value

The cost at which one could sell an asset or assume a liability in a structured exchange with market participants on the valuation date.

Q1: How does a borrower who desires a

Q18: To examine the differences between salaries of

Q27: If the yield curve is inverse, in

Q37: Identify and describe option positions and combinations

Q42: Microhard Corp.borrowed via a bank bill facility

Q78: Which of the following regression models is

Q86: A planned issue of $10million of BABs

Q91: The Sydney Futures Exchange merged with the

Q122: Some currency speculators believe the AUD is

Q125: If the model y<sub>t</sub> = T<sub>t</sub> ×