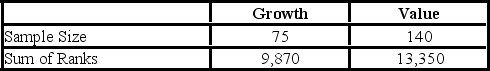

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) . The fund manager collects data on the returns of growth and value funds. Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

Definitions:

Bonds Outstanding

The total amount of bonds that have been issued by a corporation or government entity that remain unpaid.

Retirement Entry

An accounting entry that records the removal of fixed assets or inventory from the company's records upon their disposal or sale.

Discount On Bonds Payable

The difference between the face value of a bond and its selling price when a bond is sold for less than its face value.

Q9: Calculate the 120-day AUD/USD forward points if

Q48: Suppose that in June, when the 90-day

Q49: The swap rate should result in the

Q56: For the Wald-Wolfowitz runs test with n<sub>1</sub>

Q59: Discuss the contributions that the futures market

Q60: A bank manager is interested in assigning

Q73: Futures contracts have non-negotiable features.

Q99: For the Wald-Wolfowitz runs test with n<sub>1</sub>

Q104: Jack Simmons is expecting to earn a

Q121: Prices of crude oil have been steadily