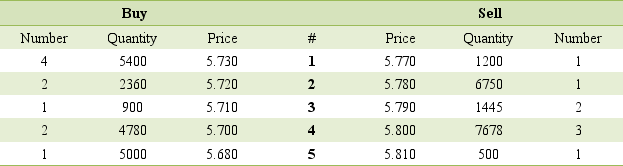

Consider the following market depth information for Fosters Group Ltd:  (a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

Definitions:

Sound

Vibrations that travel through the air or another medium and can be heard when they reach a person's or animal's ear.

Channel

The medium through which a message is sent.

Noise

Unwanted or distracting sounds, but in communication theory, it also refers to any interference that distorts or hinders the transmission of a message.

Compromise

An agreement or a settlement of a dispute reached by each side making concessions.

Q32: The 'counter-cyclical capital buffer':<br>A)can be imposed by

Q43: Of the following, which is NOT relevant

Q43: Which of the following is NOT true

Q46: Money market dealer's quotes reflect their desire

Q68: 'Marking to market' refers to the valuation

Q69: Briefly describe the sources of funds for

Q89: What characteristics do retail deposit accounts have

Q90: IPOs always raise large sums to finance

Q91: The infamous rogue trader Nick Leeson pursued

Q109: BAB futures contracts can be used to