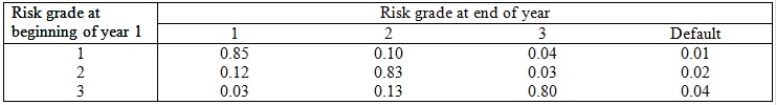

Consider the following hypothetical transition matrix:  Which of the following statements is true?

Which of the following statements is true?

Definitions:

Continuous Carbon Chain

Organic chemistry term for a series of carbon atoms connected by single or multiple bonds without branching or forming rings.

Ethylpentane

A chemical compound that is a type of hydrocarbon, specifically an alkane with the chemical formula C7H16.

Methylhexane

A type of hydrocarbon with a branched-chain structure, used in organic chemistry and industrial applications.

Propylbutane

A hydrocarbon with the formula C7H16, representing one of the various structural isomers of heptane.

Q7: By selecting and combining different economic and

Q19: When repricing all interest sensitive assets and

Q22: A transferable mortgage is a mortgage contract

Q43: Regulators seek to provide depositor protection to

Q45: Operational risk is the risk that the

Q47: Loan to value ratio is the:<br>A)loan amount

Q49: In Australia, a securitisation program must have:<br>A)a

Q57: External and internal fraud are both sources

Q60: Daylight overdrafts occur when:<br>A)FIs in different time

Q67: A forward contract is a standardised contract