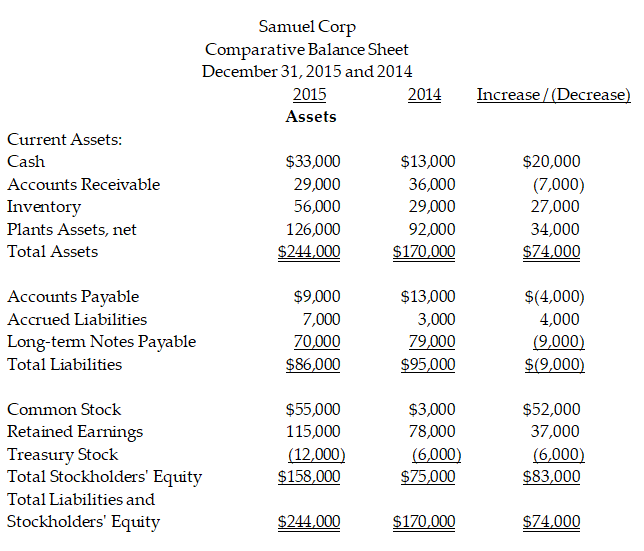

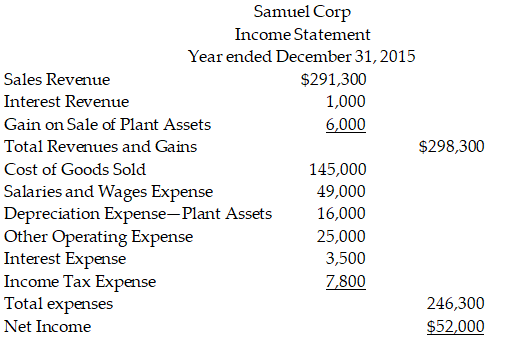

Samuel Corp. has provided the following information for the year ended December 31, 2015.

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

Depreciation Expense of $16,000 was recorded during the year.

During 2014, the company repaid $43,000 of Long-Term Notes Payable.

During 2014, the company borrowed $34,000 on a new Long-Term Note Payable

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare a complete statement of cash flows using the indirect method.

Definitions:

Impairment Loss

The reduction in the recoverable value of an asset below its carrying amount, necessitating an adjustment on the financial statements.

Cost Method

An accounting method used to record investments, where the investment is recorded at cost and income is recognized only when dividends are received.

Sales Revenue

The total amount of income generated by the sale of goods or services related to a company's primary operations.

Consolidated Income Statement

A financial statement that combines the income, expenses, and profits of a parent company and its subsidiaries.

Q5: Gordon Corporation reported the following equity

Q46: Sentrino Company uses the direct method

Q59: Preferred stockholders receive a dividend preference over

Q64: On January 1, 2013, Davie Services issued

Q89: Bilkins Financial Advisors provides accounting and finance

Q97: On June 30, 2015, Stephans Company

Q122: Companies make a year-end adjustment to trading

Q134: Joshua is the accountant of Seria Inc.

Q150: Manufacturing overhead includes indirect manufacturing costs, such

Q154: Moore Sales purchased some equipment for $50,000