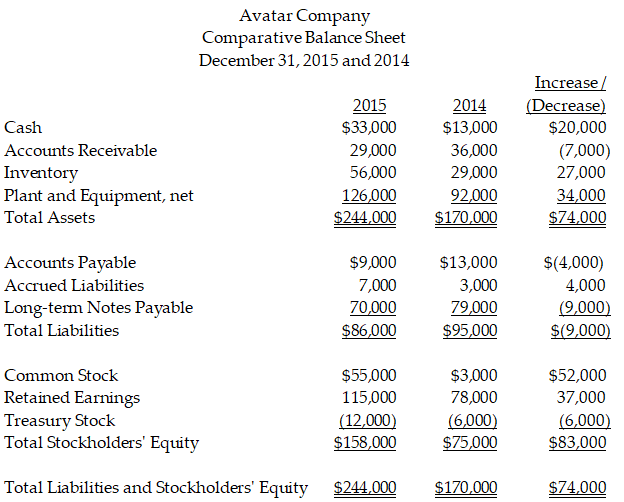

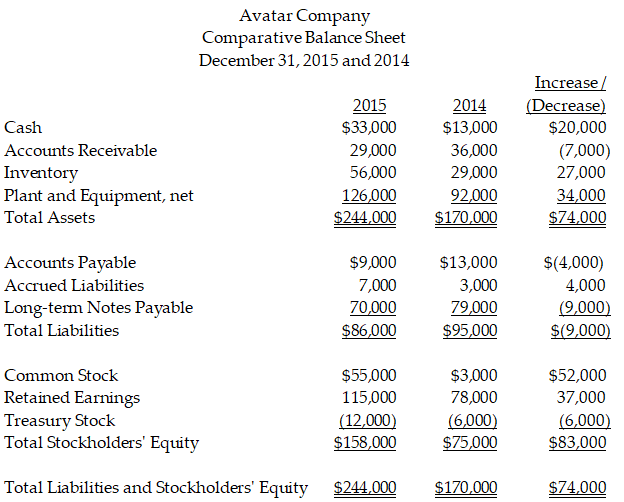

Avatar Company uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ending December 31, 2015:

Avatar Company Income Statement Year Ended December 31, 2015Sales RevenueInterest RevenueGain on Sale of Plant AssetsTotal Revenues and GainsCost of Goods SoldSalaries and Wages ExpenseDepreciation Expense-Plant AssetsOther Operating ExpenseInterest ExpenseIncome Tax ExpenseTotal expensesNet Income$291,3001,0006,000$298,300145,00049,00016,00025,0003,5007,800246,300$52,000

Avatar CompanyStatement of Retained EarningsYear Ended December 31, 2015Retained Earnings, January 1, 2014Add: Net incomeLess: DividendsRetained Earnings, December 31, 2014$78,00052,00015,000$115,000

Prepare the operating activities section of the statement of cash flows, using the direct method.

Definitions:

Long Run Entry

The process by which new firms enter a market, adjusting the supply side of the market, typically considering all factors of production as variable.

Social Welfare

Programs and policies designed to enhance the well-being of individuals and communities, often through provision of health, education, and financial support.

Banned Advertising

Advertising that is prohibited by law due to being misleading, promoting harmful products, or being offensive.

Monopolistically Competitive

This term refers to market structures where many firms sell products that are similar but not identical, allowing for some degree of market power and product differentiation.