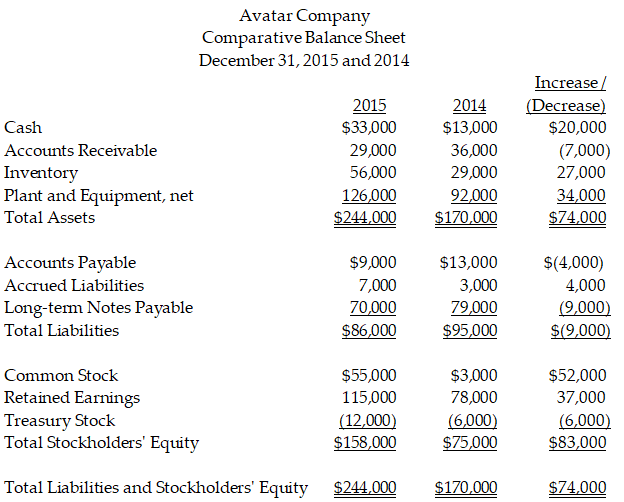

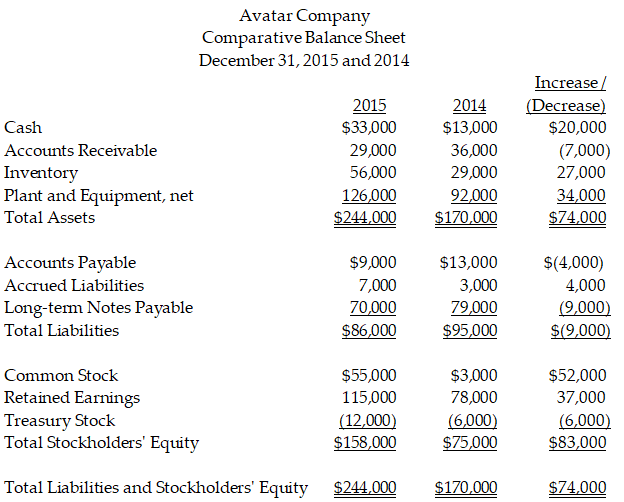

Avatar Company uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ending December 31, 2015:

Avatar Company Income Statement Year Ended December 31, 2015Sales RevenueInterest RevenueGain on Sale of Plant AssetsTotal Revenues and GainsCost of Goods SoldSalaries and Wages ExpenseDepreciation Expense-Plant AssetsOther Operating ExpenseInterest ExpenseIncome Tax ExpenseTotal expensesNet Income$291,3001,0006,000$298,300145,00049,00016,00025,0003,5007,800246,300$52,000

Avatar CompanyStatement of Retained EarningsYear Ended December 31, 2015Retained Earnings, January 1, 2014Add: Net incomeLess: DividendsRetained Earnings, December 31, 2014$78,00052,00015,000$115,000

Prepare the operating activities section of the statement of cash flows, using the direct method.

Definitions:

Key Persons

Individuals who hold critical importance within an organization or project, often due to their skills, knowledge, or position.

BCG Matrix

A strategic business tool designed by the Boston Consulting Group to help organizations evaluate and manage the relative positions of their business units or products in terms of market growth rate and market share.

Stars

High-performing and highly valuable members or units within an organization known for contributing significantly to its success.

Question Marks

Products or business units that operate in high growth markets but have a low market share, often requiring significant resources to become profitable.