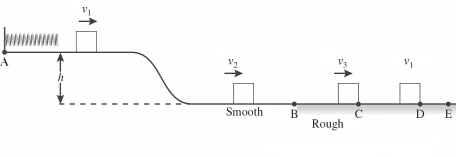

A 0.46-kg block is held in place against the spring by a 30-N horizontal external force. The external force is removed, and the block is projected with a velocity upon separation from the spring, as shown in the figure. The block descends a ramp and has a velocity at the bottom. The track is frictionless between points A and B. The block enters a rough section at point B, extending to E. The coefficient of kinetic friction between the block and the rough surface is 0.38. The velocity of the block is at point C. The block moves on to D, where it stops. What distance does the block travel between points B and D?

Definitions:

Conversion Costs

Expenses directly related to the transformation of raw materials into finished goods, typically including labor and overhead costs.

Canning Department

A division within a production facility where products are canned for preservation and future sale.

Process Cost Summary

A report detailing the total cost and production information in a process costing system, used to calculate cost per equivalent unit.

FIFO Method

An inventory valuation method that assumes the first items placed in inventory are the first sold, standing for "First In, First Out."

Q5: Oxygen molecules are 16 times more massive

Q12: In a police ballistics test, a 2.00-g

Q21: A gas is taken through the cycle

Q51: The drive chain in a bicycle is

Q51: An important feature of the Carnot cycle

Q55: A coal-fired plant generates 600 MW of

Q56: A lab assistant drops a 400.0-g

Q116: A 1500-kg car moving at 25 m/s

Q144: In an electric furnace used for refining

Q196: Consider a flat steel plate with a