Adjusting entries

Part I - Maison Corp. has reported pre-tax income of $ 250,000 for calendar 2020, before considering the five items below. Prepare the adjusting entries needed at December 31, 2020 in order to correctly state the 2020 pre-tax income. If no entry is needed, write NONE.

1. Interest on a $ 42,000, 7%, six-year note payable was last paid on September 1, 2019.

2. On May 31, 2020, Maison entered into a contract to provide services to a customer for 18 months beginning June 1. The customer paid the $ 18,000 fee in full on June 1 and Maison credited it to Service Revenue.

3. On August 1, 2020, Maison paid a year's rent in advance on a warehouse, and debited the $ 48,000 payment to Prepaid Rent.

4. Depreciation on office equipment for 2020 is $ 17,000.

5. On December 18, 2020, Maison paid the local newspaper $ 1,000 for an advertisement to be run in January of 2021, debiting it to Prepaid Advertising.

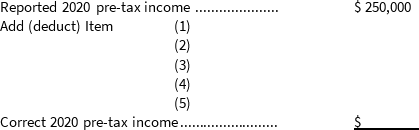

Part II - Show the effect of each adjusting entry in Part I on previously reported pre-tax income, and indicate the correct amount of pre-tax income.

Definitions:

Q5: Which statement is not correct?<br>A)Goodwill equals the

Q11: Calculate market price of a bond<br>On January

Q37: How does having significant influence over an

Q53: Non-monetary assets include<br>A) accounts and notes receivable

Q58: Mathew Corp exchanged similar assets with Simone

Q64: Which statement is not correct?<br>A)Agricultural activity involves

Q79: Wallace Inc wishes to use the

Q84: The financial statement which summarizes operating, investing,

Q95: What journal entry is required when

Q102: In December 2021, Ami, the owner of