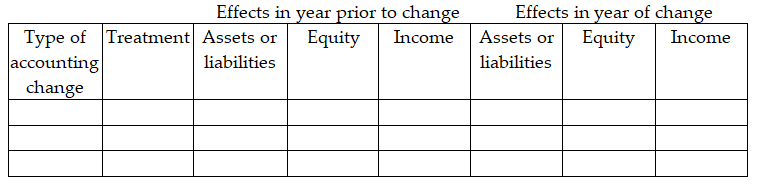

For each of the following scenarios, determine the effects (if any)of the accounting change (correction of error, change in accounting policy, or change in estimate)on the relevant asset or liability, equity, and comprehensive income in the year of change and the prior year. Use the following table for your response.

A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

B. Company B omitted to record an invoice for a $7,000 sale made on credit at the end of the previous year and incorrectly recorded the sale in the current year. The related inventory sold has been accounted for.

C. Company C changes its revenue recognition policy to a more conservative one. The result is a decrease in prior year revenue of $4,200 and a decrease in current-year revenue of $6,300 relative to the amounts under the old policy.

Definitions:

Bifurcated Consciousness

A psychological state where an individual's identity or perception is divided between two conflicting viewpoints or aspects of self, often related to social roles or cultural expectations.

Super-mom Syndrome

A societal pressure on women to excel in multiple roles flawlessly, especially in caregiving and professional achievements, often leading to stress and burnout.

Proletariat

The proletariat refers to the class of workers who do not own the means of production and must sell their labor to live, a key concept in Marxist theory.

Means of Production

The resources and tools required to produce goods and services, including land, factories, and technology, which in Marxist theory is owned by the capitalist class.

Q10: What dollar amount will be included

Q22: What journal entry is required when

Q26: Which statement best describes a publicly accountable

Q36: What is not an information need of

Q73: Net income was $418,600 in 2017 and

Q78: EasyCredit Inc. reported cash sales of $45,000,

Q85: On January 1, 2019, CC Company acquired

Q101: The following entry was recorded by

Q102: When the indirect method is used,if accounts

Q113: Which statement best explains the retail inventory