Condensed financial data of Monopoly Corporation appear below:

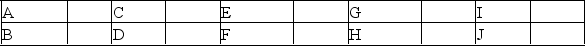

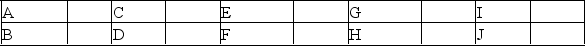

MONOPOLY CORPORATION Comparative Balance Sheet December 31 Assets Cash Accounts receivable Inventories Prepaid rent Property, plant, and equipment Accumulated depreciation Total assets Liabilities and Shareholders’ Equity Accounts payable Accrued liabilities Notes payable Contributed capital Retained earnings Total liabilities and shareholder’s equity 2018$44,000AB2,500224,000(55,000)$341,500$38,00010,000130,00050,000113,500$341,5002017$28,00032,00070,0002,000200,000(40,000)$292,000$34,00012,000150,025,00071,000$292,000

MONOPOLY CORPORATIONIncome StatementYear Ended December 31, 2018

Sales Expenses Cost of goods sold Selling, general, and administrative expenses Depreciation expense Interest expense Income taxes Net income $ 290,000 94,000 C 9,000 D $ 477,500 425,000 $ 52,500

MONOPOLY CORPORATIONCash Flow Statement - Year End Decernber 31, 2018

Cash flows from operating activities Net income Adjustments: Depreciation expense Change in inventories Change in prepaid expenses Change in accounts payable Change in accrued liabilities Change in accounts receivable Net cash provided by operating activities Cash flows from investing activities Purchase of property, plant, and equipment Net cash provided by (used for) investing activities Financing activities Additional capital contributed by shareholders Payment of principal on notes Payment of cash dividends Net cash provided by (used for) financing activities Increase in cash and cash equivalents Cash and cash equivalents, January 1Cash and cash equivalents, December 31 $52,500 15,000(20,000) E 4,000 F (4,000) G (24,000) (24,000) H (20,000) I J 16,000 28,000 $44,000

Additional information: A cash dividend was declared and paid in full during the year.

Instructions: Solve for the missing numbers and summarize your answers in the table below.Be sure to indicate in parenthesis ()if the missing number is negative (that is,a cash outflow).

Definitions:

Nonverbal Messages

Information or emotional content communicated without the use of spoken words, often through body language, facial expressions, and tone of voice.

Mild Offense

A minor wrongdoing or insult that may provoke slight anger or annoyance.

Intimate

Relating to a close, personal, and often affectionate or loving relationship.

Public Setting

A social or physical environment that is open to the general public, where interactions among individuals and groups can occur.