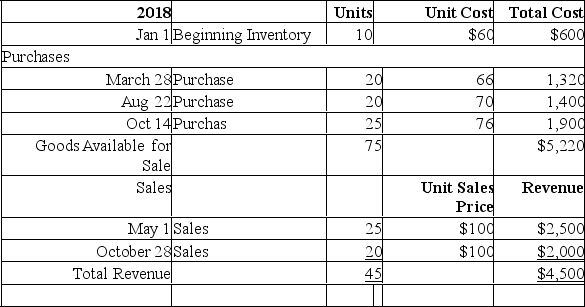

Given the following information for Maynor Company in 2018,calculate the company's ending inventory,cost of goods sold and gross profit,using the following inventory costing methods,assuming the company uses the periodic system:

a)Weighted Average

b)FIFO

c)LIFO

d)Specific Identification.(The ending inventory consisted of 15 @ $66; 10 @ $70; and 5 @ $76.)

Definitions:

Tax Gains

Profit that arises from the sale of an asset or investment which is subject to taxation.

Acquisition

The method in which a corporation acquires the majority or entirety of another firm's stock to obtain dominion over it.

Increasing Inputs

Refers to a situation in production or economics where there is a rise in the resources used to produce goods or services.

Holding Outputs

The act of retaining finished goods or services before they are sold or delivered to the next stage of the supply chain or to customers.

Q39: Corporate income taxes have to be calculated

Q50: As time passes,a bond liability creates interest

Q51: The fixed asset turnover ratio measures the:<br>A)useful

Q61: Which of the following is most likely

Q62: A transaction is an exchange or event

Q74: If a company did not extend credit

Q75: Coca-Cola reported net sales revenues of $19.8

Q78: A trucking company sold its fleet of

Q97: Analysts often interpret a sudden decline in

Q110: Plasma Inc.,has net credit sales of $500,000