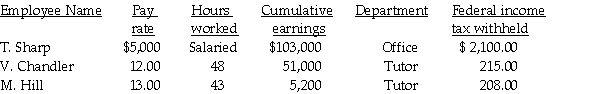

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the net pay.

Definitions:

John Hersey

An American writer and journalist known for his works including "Hiroshima," a groundbreaking account of the atomic bomb impact.

Subgroup

A division within a larger group, often characterized by shared interests or characteristics.

Team Dynamics

The unconscious, psychological forces that influence the direction of a team’s behavior and performance.

Consideration Skills

The ability to show thoughtfulness and care towards others' feelings, needs, and circumstances within interpersonal interactions.

Q5: The internal rate of return is likely

Q10: Most goods that are nonexcludable are pure

Q14: The payroll taxes the employer is responsible

Q15: "Since the social sciences are not like

Q16: Real dollar amounts are essentially the same

Q19: Command-and-control regulations<br>A) are less flexible than incentive

Q25: The Income Summary account debited and the

Q27: On Flex Company's worksheet the revenue account

Q39: The Income Summary account can be found

Q63: Compute the total gross earnings for the