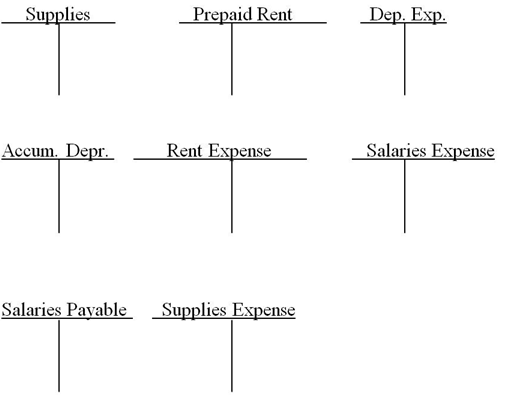

Provide the adjusting entries to account for the differences between the trial balance amounts and the adjusted trial balance amounts for the accounts shown.Only a partial trial balance is provided.Use T accounts to show the adjustments.

Definitions:

Fix Prices

An illegal agreement between parties to sell a product at a set price, limiting competition and violating antitrust laws.

Predatory Pricing

The pricing of a product below cost with the intent to drive competitors out of the market.

Antitrust Violation

An illegal activity that interferes with free competition in the market, involving practices such as monopolization, price fixing, and unlawful mergers.

Higher Profits

Describes an increase in the financial gains of a business after all expenses have been deducted.

Q10: In a manufacturing company,the purchase of

Q10: Which of the following transactions would most

Q35: <span class="ql-formula" data-value="\begin{array} { | l |

Q69: Explain the purpose of workers' compensation,and discuss

Q72: Samantha's Tutoring Service's $200 petty cash fund

Q87: If the net approach method is applied,the

Q88: A department with sales of $80,000 and

Q110: Correctly posting a transaction twice will cause

Q112: When the bank pays a check written

Q116: On a worksheet,the income statement debit column