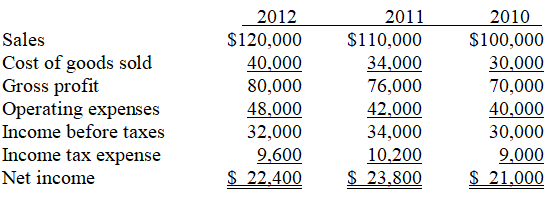

The following information is provided from EZ Electronics' annual report for the years ended December 31:

-Refer to the EZ Electronics annual report above.Using vertical analysis,2010 income tax expense would be represented as ________.

Definitions:

Repairs

Expenditures that restore an asset to its previous operating condition or maintain the asset in its current condition, without significantly enhancing its value.

Maintenance Costs

The expenses incurred to keep an asset in usable condition or restore it to its original condition without enhancing its value.

Depreciation Method

A systematic approach used to allocate the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Composite Depreciation

A depreciation method that applies a single depreciation rate to a group of assets with different lives, treating them as a single asset.

Q20: Clean Dirt,Inc.had $8,000 of salaries payable at

Q21: Horizontal analysis is a technique used to

Q23: The FASB requires that a company using

Q31: In applying the indirect method,depreciation expense is

Q51: Refer to the Ace Electronics annual

Q75: The statement of cash flows shows all

Q80: Using a smaller salvage value when calculating

Q95: Owning bonds as well as stocks is

Q181: The following information is from Ads,Inc.'s December

Q214: Which financial statement(s)do you need to calculate