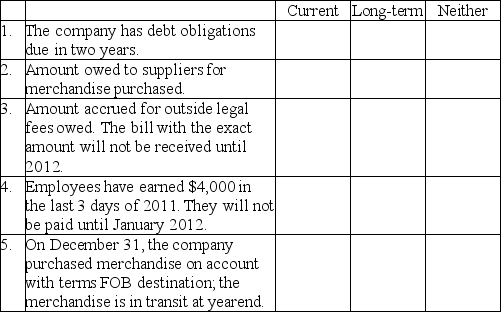

Indicate with an "X" whether each description results in the reporting of a current liability,long-term liability,or neither on the company's balance sheet.Assume a December 31,2011 yearend.

Definitions:

Call Options

Financial derivatives that give the holder the right, but not the obligation, to buy an asset at a specified price within a specific timeframe.

Black-Scholes OPM

A mathematical model used to estimate the price of European-style options, taking into account factors like volatility, underlying asset price, and time to expiration.

Exercise Price

The specified price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

Bullish Outlook

An expectation that a market, security, or economy will rise in value in the foreseeable future.

Q22: Jill,Inc.earned $950,000 on account during 2011.Customers owed

Q46: The debt-to-equity ratio _.<br>A)compares the amount of

Q48: Negative cash flow from financing activities on

Q50: Team Shirts issued a 10% stock dividend.The

Q53: The following information is from Avatar,Inc.'s December

Q186: Use the following information from Artizan,Inc.'s computerized

Q192: Team Shirts issued 20,000 shares of stock

Q225: Kim Brother Fitness Center had common shareholders'

Q240: Regardless of whether the statement of cash

Q289: What is an annuity?