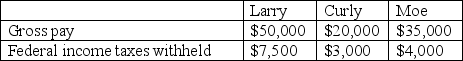

Albert,the accountant,has been asked by his boss to calculate the net pay for each of Pinnock Company's three employees.Albert has gathered the following information about payroll for the period:

Required: Calculate the net pay for each of the employees.Assume that FICA (Social Security)taxes are withheld at the rate of 6.2% of gross pay and that Medicare taxes are withheld at the rate of 1.45% of gross pay.

Required: Calculate the net pay for each of the employees.Assume that FICA (Social Security)taxes are withheld at the rate of 6.2% of gross pay and that Medicare taxes are withheld at the rate of 1.45% of gross pay.

Definitions:

Asset

Property or something of value owned by a person or business that is considered as a resource having economic value expected to provide future benefits.

Stockholders' Equity

The remaining interest in a company's assets after its liabilities are subtracted, signifying ownership stake.

Liabilities

Financial obligations or debts owed by a company to creditors, which must be settled over time through the transfer of assets, provision of services, or other economic benefits.

Assets

Resources owned or controlled by a business that are expected to produce economic value or benefits in the future.

Q13: Treasury stock is shown as _ on

Q65: Each time a company makes a payment

Q71: Explain the concept of time value of

Q76: The direct method for the preparation of

Q100: On July 1,2011,Ace Electronics issued $10 million

Q100: Why do corporations purchase and own treasury

Q114: On June 30,2011,Xanadu Corporation issued $200,000 of

Q146: Which statement about accelerated depreciation methods is

Q212: Identify each of the liabilities listed below

Q233: The statement of cash flows is designed