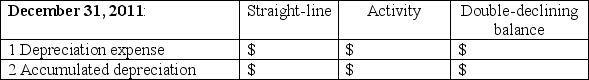

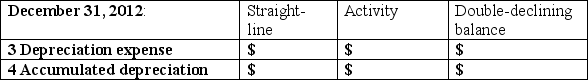

On January 1,2011,Borba,Inc.purchased a $100,000 machine with an estimated useful life of 10 years or 1,000,000 units and a $10,000 salvage value.The machine actually produced 120,000 units in 2011 and 110,000 units in 2012.

Part A: Calculate depreciation expense and accumulated depreciation using the following three methods:

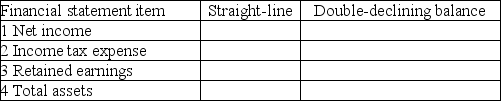

Part B: In the first year of the machine's life,which method would show the LOWER amount for each of the following financial statement line items? Put an X in the appropriate box.

Part B: In the first year of the machine's life,which method would show the LOWER amount for each of the following financial statement line items? Put an X in the appropriate box.

Definitions:

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered on credit.

Notes Payable

Written agreements in which one party agrees to pay another party a certain sum of money at a future date or on demand.

Debit

An accounting entry that results in either an increase in assets or a decrease in liabilities on a company's balance sheet.

Capital

Financial assets or the resources that businesses use to fund their operations and growth, including cash, properties, and equipment.

Q35: Assume Tyler,Inc.had a gross profit ratio of

Q52: On July 31,the accountant for Team Shirts

Q59: A company that uses a perpetual inventory

Q62: Excess,Inc.'s corporate charter allows it to sell

Q65: Which depreciation method is most like the

Q74: On December 29,Perch X,Inc.purchased $2,000 of merchandise

Q125: On June 1,beginning inventory consists of ten

Q181: Capitalizing a cost means to record the

Q214: Use the following data to answer the

Q239: On December 31,2010,a company purchased a $100,000