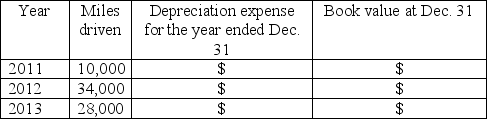

On February 1, 2011, Delta Distribution Company purchased a delivery truck that cost $30,000. The truck has an estimated useful life of 150,000 miles and an estimated salvage value of $3,000. The truck is driven 10,000; 34,000; and 28,000 miles for the years 2011, 2012, and 2013, respectively.

Required:

1. Calculate the depreciation expense per mile using the activity (units-of-production) method.

2. Use the activity method to complete the chart below: 3.Explain why long-term assets must be depreciated,rather than recorded as expenses in the period when the asset is purchased.

3.Explain why long-term assets must be depreciated,rather than recorded as expenses in the period when the asset is purchased.

4.Explain why land is NOT depreciated when other assets,such as trucks,are depreciated.

Definitions:

Underconfidence

A cognitive bias in which individuals underestimate their knowledge, abilities, or performance.

Frontal Lobe

A division of the cerebral cortex located just beneath the forehead that contains the motor cortex, premotor cortex, and prefrontal cortex.

Phineas Gage

A famous case in neuroscience where an individual survived a severe brain injury, leading to insights on the relationship between brain physiology and personality.

Optimal Outcome

A condition or result that is the most favorable or advantageous under the given circumstances.

Q118: Bad debts expense appears on the income

Q132: The allowance method provides a good match

Q136: On SEPTEMBER 30,2011,Ace Electronics issued $100,000

Q139: A machine was purchased for $100,000 in

Q163: On a bank reconciliation,outstanding checks and NSF

Q170: On January 1 2010,Max,Inc.paid $80,000 for a

Q195: Which of the following assets should be

Q206: A bond is _.<br>A)debt sold to investors<br>B)long-term

Q254: Beau Brentley earned $60,000 from his job

Q255: Beau Brentley earned $60,000 in 2011 from