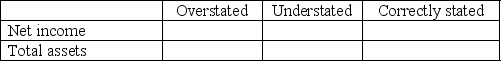

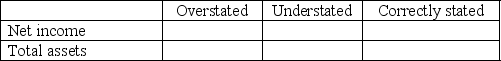

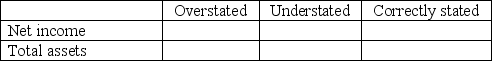

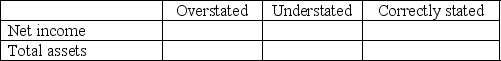

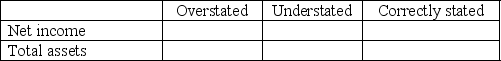

Robin Blind,Inc.recorded the following entries during the year.Put an X in the appropriate box to indicate whether each entry caused net income and total assets to be overstated,understated,or correctly stated.

1.Recorded depreciation for the year using $0 salvage value when the salvage value was expected to be $5,000.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

3.Recorded ordinary repairs as capital expenditures.

3.Recorded ordinary repairs as capital expenditures.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

5.Recorded its research and development costs as expenses.

5.Recorded its research and development costs as expenses.

Definitions:

Graphical Techniques

The use of plots, charts, and graphs to visualize, interpret, and analyze data.

Distribution

In statistics, it refers to the way in which values of a variable or a set of variables are spread or dispersed across a range of values.

Magnitude

A quantitative measure of size or extent, often used in context to describe the importance or severity of a variable or event.

Correlation Coefficient

A numerical measure that indicates the extent of a linear relationship between two variables, ranging from -1 to 1.

Q43: On January 1,2011,Nadir Company issued $1,000,000 of

Q94: Benefits of allowing customers to use credit

Q101: The company has a policy of waiting

Q114: On June 30,2011,Xanadu Corporation issued $200,000 of

Q132: A machine was purchased for $100,000 in

Q140: Team Shirts decided to accept bankcards from

Q175: Identify each of the assets listed below

Q176: After a lower-of-cost-or-market write down,Inventory will _.<br>A)increase

Q182: Bad debts on the income statement will

Q233: IFRS require publicly-traded corporations to use _.<br>A)the