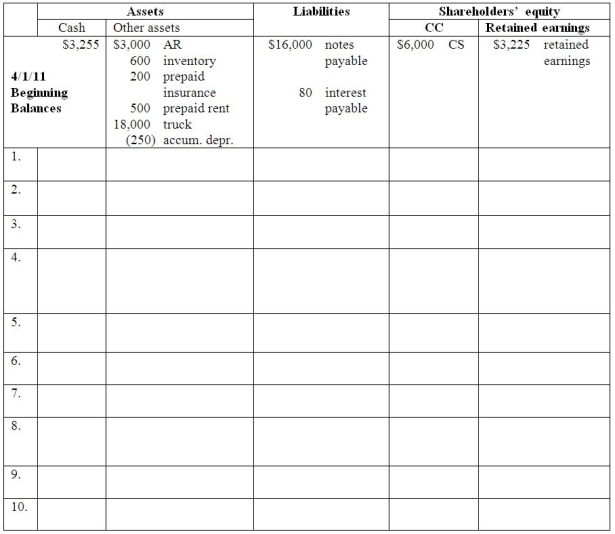

Part A:

Enter the April 2011 transactions and adjustments for Tim's Tams in the accounting equation.

1.April 1 Collected $3,000 of accounts receivable from March sales.

2.April 2 Purchased 1,200 caps @ $6 each on account.

3.April 6 Paid $700 cash for office supplies.

4.April 20 Tim's Tams sold 800 baseball caps @ $10 each on account.Cost of goods sold was $4,800.

5.April 30 Tim's Tams declared and paid a $400 cash dividend to its shareholder.

6.April 30 Adjusted for insurance used during the month.On February 1,Tim's Tams paid $600 for 3 months of insurance coverage that began February 1.

7.April 30 Adjusted for rent used during the month.Last month Tim's Tams paid $1,000 for two months' rent.

8.April 30 Recorded one month's straight-line depreciation on the $18,000 truck that has a 6-year useful life and no salvage value.

9.April 30 Counted the office supplies and found that $200 of supplies have not been used.

10.April 30 Recorded interest on the $16,000,4-month,6% note payable for the month.  Parts B,C,D and E: Complete the financial statements.

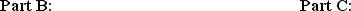

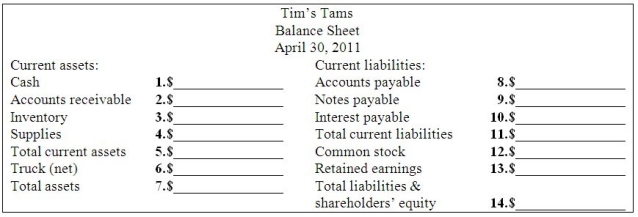

Parts B,C,D and E: Complete the financial statements.

Part D:

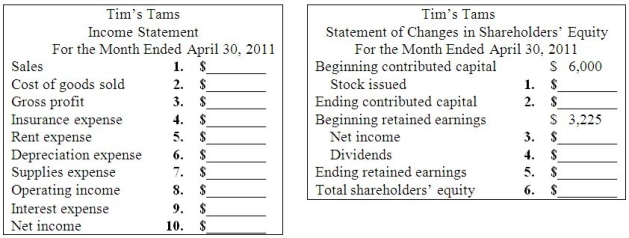

Part D:  Part E:

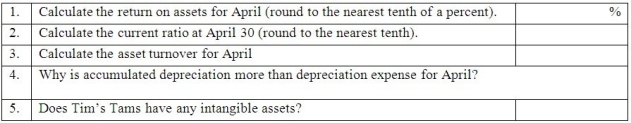

Part E:  Part F: Using the financial statements above,answer the following questions:

Part F: Using the financial statements above,answer the following questions:

Definitions:

Internet

A global network of interconnected computers and servers allowing for the exchange of data, communication, and resources.

Participant Modeling

A therapeutic technique in which a therapist demonstrates a desired behavior to a client, who is then encouraged to imitate this behavior.

Effectiveness

The degree to which something is successful in producing a desired result or outcome.

Psychotherapy

A method of treating mental health problems by talking with a psychiatrist, psychologist, or another mental health provider.

Q13: The accountants for Ruiz Imports need to

Q28: Lee's Lions had a balance of a

Q123: Amortization is the _.<br>A)allocation of a natural

Q147: Thyme,Inc.'s inventory turnover ratio has been approximately

Q171: On January 1,2011,Alpha Company issued $1,000,000 of

Q174: Principal = rate multiplied by time multiplied

Q178: Mighty Ducks,Inc.'s inventory activity in October 2011

Q241: The accountant for Buy & Large,Inc.needs to

Q260: Bondholders are considered owners of a company.

Q273: On January 1,2011,Alpha Enterprise signed a $100,000,6%,20-year